Things tagged economics:

Dirty dealing in the $175 billion Amazon Marketplace

Josh Dzieza at The Verge:

For sellers, Amazon is a quasi-state. They rely on its infrastructure — its warehouses, shipping network, financial systems, and portal to millions of customers — and pay taxes in the form of fees. They also live in terror of its rules, which often change and are harshly enforced. A cryptic email like the one Plansky received can send a seller’s business into bankruptcy, with few avenues for appeal.

Sellers are more worried about a case being opened on Amazon than in actual court, says Dave Bryant, an Amazon seller and blogger. Amazon’s judgment is swifter and less predictable, and now that the company controls nearly half of the online retail market in the US, its rulings can instantly determine the success or failure of your business, he says. “Amazon is the judge, the jury, and the executioner.”

Via Schneier on Security.

The man who created the last index

This note is a work of fiction that addresses the role of indexation and passive management in investing today. It covers the origins of indexation and how the role that an index is expected to perform has now changed. The rapid growth in the number of indices presents a problem for investors in that it becomes harder to articulate what is meant by a passive investment. This leads to a discussion of the work of Borges and Balzac and what it means for investing.

Via Matt Levine.

Efficient Promotion Strategies in Hierarchical Organizations

Alessandro Pluchino, Andrea Rapisarda, Cesare Garofalo:

The Peter principle has been recently investigated by means of an agent-based simulation and its validity has been numerically corroborated. It has been confirmed that, within certain conditions, it can really influence in a negative way the efficiency of a pyramidal organization adopting meritocratic promotions. It was also found that, in order to bypass these effects, alternative promotion strategies should be adopted, as for example a random selection choice. In this paper, within the same line of research, we study promotion strategies in a more realistic hierarchical and modular organization and we show the robustness of our previous results, extending their validity to a more general context. We discuss also why the adoption of these strategies could be useful for real organizations.

How important is economic growth?

Scott Sumner with a bit of wisdom in a review of Tyler Cowen’s Stubborn Attachments:

Unfortunately, when discussing redistribution, our society tends to focus on income, which is the wrong variable. Yes, the rich might invest an extra dollar in income, thereby helping future generations. But that’s not relevant to the real issue, which is consumption redistribution. One commenter suggested that it might be better if I invested $10,000 rather than donate the money to a family in Ethiopia. But that’s dodging the real question—don’t I have an ethical obligation to donate $10,000 of my current consumption? The rich should never feel any guilt about investing money rather than giving it to charity. Where they perhaps should feel a bit of guilt is in spending $500 million on consumption, rather than donating a significant share of those funds to the poor.

Japan's Hometown Tax

The Japanese employment market has a curious feature: there are regions of Japan with extremely high economic productivity (such as Tokyo, Osaka, and Nagoya, but for the purpose of this issue think “Tokyo” and you won’t be wrong) and regions with low economic productivity (substantially everywhere else). This counsels that a young person born and educated in e.g. Gifu move to Tokyo after graduation to earn a living.

Many, many do. While Japan’s overall population is declining, Tokyo’s increases by about 100,000 people per year.

Educating children is incredibly expensive. The regions are quite annoyed that they pay to educate their children but that Tokyo reaps all the benefits. This state of affairs has continued for decades.

But Japan has a policy response for it, and it is sort of beautiful. Called ふるさと納税 (Furusato Nouzei or, roughly, the Hometown Tax System) [ … ]

Via Matt Levine.

Building skyscrapers

Artir at Nintil responds to a Patrick Collison question, and Tyler Cowen calls it one of the best things written this year.

Rat in Broth

Matt Levine's daily commentary on financial matters frequently makes me giggle. Here is a particularly good one:

“Rat in Broth Wipes $190 Million Off Restaurant Chain’s Value” is the unappetizing headline here: Shares of Xiabuxiabu Catering Management, a Chinese public company, lost 12.5 percent of their value in two days after, you know, Rat in Broth. Rat in Broth will do that. (There’s a picture.) But the thing about Rat in Broth is that anyone could put a Rat in Broth, leading at least one person to speculate on Twitter about the possibility that this could be “intentional share price manipulation.” [ … ]

One thing I will say for short sellers is that many of them really do believe their (standard, correct) claims about their role in financial markets: that they make markets more efficient, deflate bubbles, root out fraud and delusion, and generally make the world better with their unpopular and negative activity. They see it as a noble but misunderstood calling.

Obviously you could approach short selling in a totally different way: You could short a perfectly good company and then try to blow up its factories, murder its executives and put rats in its broth. This would be strictly inefficient, not only from a financial-market perspective but also from a product-market one: If this was really how short selling worked, then all our cars would fall apart and all of our broth would have rats in it.

Mark to market

Matt Levine at Bloomberg:

In other totally normal unicorn rapid valuation-doubling news:

SoftBank Group Corp. is in discussions to invest another giant slug of capital in WeWork Cos., with a deal that would value the shared-office company at $35 billion to $40 billion, according to people familiar with the matter.

Such an investment would roughly double WeWork’s $20 billion valuation, set last August when SoftBank invested $4.4 billion in the company.

I have to say, if SoftBank is going to become the entire market for hot private technology startups, then every valuation is going to be marked-to-SoftBank, and the numbers will start to lose their meaning.

SoftBank: Would you like some money at a $10 billion valuation?

Startup: Sure.

SoftBank: Here you go. Would you like some more at a $20 billion valuation?

Startup: Sure.

SoftBank: Here you go. How about a $40 billion valuation?

Startup: This is dumb but it’s not like we’re going to say no.

SoftBank: Here you go.

Startup: Thanks brb buying a yacht.

SoftBank: Our mark-to-market investment returns are tremendous, we must be good at this.

The enduring link between demography and inflation

Mikael Juselius and Előd Takáts in BIS:

Our paper is the first to look at the potential link between the population’s age structure and inflation, taking a very long-term view. Our data go back to 1870 and cover 22 countries. We find a strong relationship that potentially calls into question conventional monetary theories.

Cryptocurrencies: Irrational Exuberance or Brave New World?

Painful to watch, but instructive if you want to know how people who don’t really get it, but are important enough to be invited to a Milken panel approach crypto.

Why don't cities grow without limit?

Tyler at MR:

Paul Krugman has a good blog post on that topic, here is one of his points:

…once upon a time dispersed agriculture ensured that small cities serving rural hinterlands would survive. But for generations we have lived in an economy in which smaller cities have nothing going for them except historical luck, which eventually tends to run out.

Krugman suggests that eventually many smaller cities will indeed fade away, although the process of equilibration may be a long and slow one. All of his points are well-founded, nonetheless I can see a few factors favoring the continuing existence of small cities on a greater scale than many might be expecting:

I agree with both. Competitive growth oriented businesses will locate in large cities, but cost of living and welfare can be more efficiently had in smaller. I see some balance. Also, foot voting wants choices and differentiation …

Whereof One Cannot Speak, Thereof One Must Be Silent

Sumner with an interesting anti-bubble-theory thought at EconLib: (EMH is Efficient Market Hypothesis)

The EMH doesn’t do a good job of explaining the 1987 stock market crash, or the 2000-02 tech stock crash. It’s hard to find fundamentals that would justify such a dramatic shift in prices over a short period of time. (Actually much harder for the 1987 crash than the tech stock declines, which took considerably longer.) So how do I defend the EMH? Two points:

The EMH is very useful to me in all sorts of ways. It’s also consistent with a lot of research on the wisdom of crowds, and basic economic ideas such as competitive rates of return in competitive markets with free entry. It’s got a lot going for it. Because of the EMH, I’ve invested in index funds, and also engaged in buy and hold of stocks (not day trading). I ignored Shiller’s 2011 comments on overvalued stocks. My 401k has done very well as a result. It also helped me during my research on the Great Depression, when I found that market responses to policy shocks were much more perceptive that expert opinion, even the expert opinion of Friedman and Schwartz.

The EMH cannot explain certain puzzling facts. (Matthews right about that). And on these points we should just keep our mouths shut.

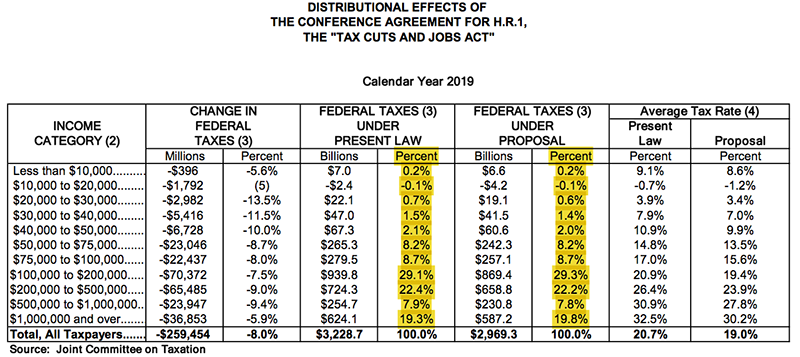

Distributional Impact of the Tax Cuts and Jobs Act

Quiz for you: Do “the rich” pay less taxes under the new tax plan?

Ok, now look at this data:

Sill say so? By what definition?

Via John Cochrane.

The hard road of free markets

John Cochrane lays down some wisdom:

The sad paradox of free markets is that free markets do not need people to understand them to work. But democracy does require voters to understand how things work.

CFE:XBT/F8

If anyone has a futures trading account with access to CFE:XBT/F8 there is currently a cash and carry arbitrage for $1200 on one month lockup of 30k.

(Arrrrg)

P.S. Hah, I was right: http://archive.is/ZIo5H

Himmelfarb on why intellectuals hate capitalism

Alberto Mingardi at Econlog:

It is not the fault of capitalism that the common man does not appreciate uncommon books. -Ludwig von Mises

There are many gems in Gertrude Himmelfarb’s Past and Present. The Challenges of Modernity, from the Pre-Victorians to the Postmodernists.

One is a 1952 essay on “American Democracy and Its European Critics”. In that essay, in comparing Tocqueville’s reading of America with Harold Laski’s (in The American Democracy), Himmelfarb notes perceptively that critics of American culture tend to see that “the incubus of Big Business lies heavily upon the whole country, stifling individual expression and corrupting individual tastes”.

But we know well that successful enterprises, cultural enterprises included, basically provide people with something that they want.

The Uber Tipping Equilibrium

Alex Tabarrok at MR:

What is the effect of tipping on the take-home pay of Uber drivers? Economic theory offers a clear answer. Tipping has no effect on take home pay. The supply of Uber driver-hours is very elastic. Drivers can easily work more hours when the payment per ride increases and since every person with a decent car is a potential Uber driver it’s also easy for the number of drivers to expand when payments increase. As a good approximation, we can think of the supply of driver-hours as being perfectly elastic at a fixed market wage. What this means is that take home pay must stay constant even when tipping increases.

[…]

At this point many readers will object that I am a horrible person and this is all theory using unrealistic “Econ 101” assumptions of perfectly competitive markets, rationality, full information etc etc. To which my response is that the first claim is plausible but irrelevant while the second is false. A new paper, Labor Market Equilibration: Evidence from Uber, from John Horton at NYU-Stern and Jonathan Hall and Daniel Knoepfle, two economists at Uber, looks at what happens when Uber increases base fares.

Delaware's Odd, Beautiful, Contentious, Private Utopia

Jesse Walker in Reason:

Arden’s origins go back to the Delaware Invasion of 1895 and ‘96, when the Single Tax movement tried to take over the state. The Single Taxers were followers of Henry George, a 19th century economist who argued that government should be financed solely by a tax on land values. No income tax, no sales tax, no tax on the improvements to a property—just one tax on land. The campaigners crisscrossed the state in armbands, knapsacks, and Union Army uniforms, delivering streetcorner speeches and singing Single Tax songs (“Get the landlords off your backs/With our little Single Tax/And there’s lots of fun ahead for Delaware!”). More than a few got tossed in jail for their efforts.

The invasion was a flop. A disaster, really. Not only did their gubernatorial candidate get only 2.4 percent of the vote, but within a year the movement’s foes would insert a provision into the state constitution that made a George-style tax impossible.

Unable to achieve their ideas at the ballot box, a group of Georgists decided to take another approach. In 1900 they acquired some farmland outside Wilmington, created what amounted to a community land trust, leased out plots to anyone who wanted to move in, levied rents based on the value of the unimproved land, and used the rent money to pay for public goods. In other words, they set up a private town and enacted the Single Tax program contractually. And with that double experiment in communalism and privatization, Arden was born.

Economics of AI

On 13-14 September, 2017, we held our inaugural conference in Toronto to set the research agenda on The Economics of AI.

Paper presentations are good, but holy shit the comments are amazing.

Check the conference site for the papers and slides.