Things tagged economics:

How Washington Made Harvey Worse

Michael Grunwald in Politico:

Hurricane Harvey was a disaster foretold.

Nearly two decades before the storm’s historic assault on homes and businesses along the Gulf Coast of Texas this week, the National Wildlife Federation released a groundbreaking report about the United States government’s dysfunctional flood insurance program, demonstrating how it was making catastrophes worse by encouraging Americans to build and rebuild in flood-prone areas.

Is it fair to say that most social programmes don't work?

Lots of government and charity programmes aim to improve education, health, unemployment and so on. How many of these efforts work?

The vast majority of social programs and services have not yet been rigorously evaluated, and…of those that have been rigorously evaluated, most (perhaps 75% or more), including those backed by expert opinion and less-rigorous studies, turn out to produce small or no effects, and, in some cases negative effects.

This estimate was made by David Anderson in 2008 on GiveWell’s blog. At that time, he was Assistant Director of the Coalition for Evidence-Based Policy.

This has become a widely-quoted estimate, especially in the effective altruism community, and often gets simplified to “most social programmes don’t work”. But the estimate is almost ten years old, so we decided to investigate further. We spoke to Anderson again, as well as Eva Vivalt, the founder of AidGrade, and Danielle Mason, the Head of Research at the Education Endowment Foundation.

We concluded that the original estimate is reasonable, but that there are many important complications. It seems misleading to say that “most social programmes don’t work” without further clarification, but it’s true that by focusing on evidence-based methods you can have a significantly greater impact.

Minimum Wage and Restaurant Hygiene Violation: Evidence from Food Establishments in Seattle by Subir Chakrabarti, Srikant Devaraj, Pankaj Patel

No free lunch, hygiene edition:

We assess the effects of rise in minimum wages on hygiene violation scores in food service establishments. Using a difference-in-difference analysis on hygiene rating of food establishments in Seattle [where minimum wage increased annually between 2010 and 2013] as the treated group and from New York City [minimum wage was constant] as the control group, we find an increase in real minimum wage by $0.10 increased total hygiene violation scores by 11.45 percent. Consistent with our theoretical model, an increase in minimum wage in Seattle has no influence in more severe (red) violations, and a significant increase in less severe (blue) violations. Our findings are consistent while using an alternate control group - Bellevue City, King County, located near Seattle.

Human Theory of the Left

Eliezer Yudkowsky on Facebook, so quoted in it’s entirety here for posterity:

Bryan Caplan’s Simplistic Theory of Left and Right says “The Left is anti-market and the Right is anti-Left”. This theory is half wrong, and will for this reason confuse the Left in particular. It ought to be a clue that if you ask the Left whether they’re anti-market, most of the Left will answer, “Of course not,” whereas if you ask the Right whether they’re anti-Left, they’ll answer “Hell yes we are.” People may understand themselves poorly a lot of the time, but they often know what they hate.

My “Human Theory of the Left” is as follows: The Left holds markets to the same standards as human beings.

Consider a small group of 50 people disconnected from the outside world, as in the world where humans evolved. When you offer somebody fifty carrots for an antelope haunch, that price carries with it a great array of judgments and considerations, like whether that person has done you any favors in the past, and how much effort it took them to hunt the antelope, and how much effort it took you to gather the carrots. If you offer them an unusually generous price, you’d expect them to give good prices in return in the future. A low price is either a status-lowering insult, or carries with it a judgment that the other person already has lower status than you.

And that’s what the Left sees when they look at somebody being paid $8/hour. They don’t see a supply curve, or a demand curve; or a tautology that for every loaf of bread bought there must be a loaf of bread sold, and therefore supply is always and everywhere equal to demand; they don’t see a price as the input to the supply function and demand function which makes their output be equal. They see a judgment about how hard an employee works, and how much they need and deserve.

So of course they hate whatever looks at a poor starving mother and says “$8/hour”. Who wouldn’t?

Ask them and they’ll tell you: They don’t hate markets. They just think that the prices and outcomes aren’t fair, and that tribal action is required for everyone to get together and decide that the prices and outcomes should be fairer.

If this post gets shared outside my own feed, some people will be reading this and wondering why I wouldn’t want prices to be fair.

And they’ll suspect that I must worship the Holy Market and believe its prices to be wise and fair; and that if I object to any regulation it’s because I want the holy, wise and fair Market Price to be undisturbed.

This incidentally is what your non-economist friends hear you saying whenever you use the phrase “efficient markets”. They think you are talking about market prices being, maybe not fair, but the most efficient thing for society; and they’re wondering what you mean by “efficiency”, and who benefits from that, and whether it’s worth it, and whether the goods being produced by all this efficiency are actually flowing to the people making $8/hour.

You reply, “What the hell that is not even remotely anything the efficient markets hypothesis is talking about at all, you’re not even in the right genre of thoughts, the weak form of the EMH says that the supply/demand-intersecting price for a highly-liquid well-traded financial asset is a rational subjective estimate of the expectation of its supply/demand-intersecting price two years later taking into account all public information, because otherwise it would be possible to pump money out of the predictable price changes. The EMH is a descriptive statement about price changes over time, not a normative statement about the relation of asset prices to anything else in the outside world.”

This is not a short paragraph in the standard human ontology.

“So you think that $8/hour wages are efficient?” they say.

“No,” you reply, “that’s just not remotely what the word efficient means at all. The EMH is about price changes, not prices, and it has nothing to do with this. But I do think that $8/hour is balancing the supply function and the demand function for that kind of labor.”

“And you think it’s good for society for these functions to be balanced?” they inquire.

The one is willing to consider the force of the argument they think they’re hearing–that the market is a weird and foreign god which will nonetheless bring us the right benefits if we make it the right sacrifices. But, they respond, is the market god really bringing us these benefits? Aren’t some people getting shafted? Aren’t some people being sacrificed to save others, maybe a lot of people being sacrificed to save a few others, and isn’t that worth the tribe getting together and deciding to change things?

And you clutch your hair and say, “No, you don’t get it, you know the market is doing something important but you don’t understand what that thing is, you think the markets are like arteries carrying goods around and they can get blocked and starve some tissues, and you want to perform surgery on the arteries to unblock them, but actually THE MARKETS ARE RIBOSOMES AND YOU’RE TRYING TO EDIT THE DNA CODE AND EVERYTHING WILL BREAK SIMULTANEOUSLY LIKE IT DID IN VENEZUELA.”

And what they hear you saying is “The markets are wise, and their prices carry wisdom you knoweth not; do you have an arm like the Lord, and can your voice thunder like His?”

Because, they know in their bones, when a corporation pays an employee $8/hour, it means something. It means something about the employer and it says something about what the employer believes about the employee. And if you say “WAIT DON’T MESS WITH THAT” there’s a lot of things you might mean that have short sentences in their ontology: you could mean that you believe $8/hour is the fair price; you could mean you believe the price is unfair but that it’s worth throwing the employees under the bus so that society keeps functioning; you could believe that maybe the market knows something you don’t.

And all of those things, one way or another, are saying that you believe there’s some virtue in that $8/hour price, some virtue transmitted to it by the virtue you think is present within the market that assigns it. And that’s a cruel thing to say to someone getting $8/hour, isn’t it?

Just look at what the market does. How can you believe that it’s wise, or right, or fair?

And they can’t believe that you don’t think that–even though you’ll very loudly tell them you don’t think that–when you are being like “IF YOU WANT THEM TO HAVE MORE MONEY THEN JUST GIVE THEM MONEY BUT FOR GOD’S SAKE DON’T MESS WITH THE NUMBER THAT SAYS 8.”

This by the way is another example of why it’s an important meta-conversational principle to pay a lot of attention to what people say they believe and want, and what they tell you they don’t believe and want. And that if nothing else should give you pause in saying that the Left is anti-market when so many moderate leftists would immediately say “But that’s not what I believe!”

Maybe we’d have an easier time explaining economics if we deleted every appearance of the words “price” and “wage” and substituted “supply-demand equilibrator”. A national $15/hour minimum supply-demand equilibrator sounds a bit more dangerous, doesn’t it? Increase the Earned Income Tax Credit, or better yet use hourly wage subsidies. Establish a land value tax and give the money to poor people, while being careful not to establish new paperwork requirements that exclude busy or struggling people and being careful about phaseout thresholds. Or if you really insist on looking at things in the simplest possible way, then take money away from rich people and give it to poor people. It’ll do less damage than messing with the supply-demand equilibrators.

I feel like I’m at a banquet watching people trying to eat the plates and they’re like “No, no, I understand what food does, you’re just not familiar with the studies showing that eating small amounts of ceramic doesn’t hurt much” and I’m like “If you knew what food does and what the plates do then you would not be TRYING to eat the plates.”

I honestly wonder if we’d have better luck explaining economics if we used the metaphor of a terrifying and incomprehensible alien deity that is kept barely contained by a complicated and humanly meaningless ritual, and that if somebody upsets the ritual prices then It will break loose and all the electrical plants will simultaneously catch fire. Because that probably is the closest translation of the math we believe into a native human ontology.

Want to help the bottom 30%? Don’t scribble over the mad inscriptions that are closest to them, trying to prettify the blood-drawn curves. Mess with any other numbers than those, move money around in any other way than that, because It is standing very near to them already.

People like Bryan Caplan see people in 6000BC wearing animal skins as the native state of affairs without the Market. People like Bryan keep trying to explain how the Market got us away from that, hoping to foster some good feelings about the Market that will lead people to maybe have some respect for its $8/hour figure.

If my Human Theory of the Left is true, then this is exactly the wrong thing to say, and eternally doomed to failure. To praise that which would offer $8/hour to a struggling family, is directly an insult to that family, by the humanly standard codes of honor. If you want people to leave the $8/hour price alone, and you want to make the point about 6000BC, you could maybe try saying, “And that’s what Tekram does if you have no price rituals at all.”

But don’t try to tell them that the Market is good, or wise, or kind. They can see with their own eyes that’s false.

Some good discussion in the comments, including from Caplan.

Federalism in Blue and Red

Are you a liberal that lives in a rich blue state? Do you look down on red states that cut services as they cut taxes? Perhaps you should check your privilege, and read this excellent article by Joshua T. McCabe on fiscal capacity in National Affairs:

In 2012, Republican governor Sam Brownback and the Republican state legislature in Kansas undertook what would soon be characterized as a radical experiment in supply-side economics. Over the following several years, they reduced the state’s progressive income tax from a top rate of 6.45% down to 4.6% and essentially raised the state’s sales tax from 5.7% to 6.5%. Grover Norquist and Art Laffer were ecstatic while liberals predicted gloom and doom. Five years later, as revenues plunged and the legislature scrambled to find enough money to fund schools and basic services, liberal pundits around the country let out a collective “I told you so.”

Meanwhile, few people noticed that analogous changes were underway in true-blue Massachusetts. In 2009, Democratic governor Deval Patrick and the Democratic state legislature likewise raised the state’s sales tax from 5% to 6.25%. Over the following several years, that same legislature — but with Republican governor Charlie Baker — reduced the state’s flat income tax from 5.3% to 5.1%. Despite strikingly similar shifts in its tax structure, Massachusetts received essentially no praise from supply-side evangelists or condemnation from liberal pundits. More important, no budget crisis followed. What explains these divergent outcomes following similar tax reforms?

A John Bates Clark Prize for Economic History

Kevin Bryan discusses the work of Dave Donaldson:

A canonical example of Donaldson’s method is his most famous paper, written back when he was a graduate student: “The Railroads of the Raj”. The World Bank today spends more on infrastructure than on health, education, and social services combined. Understanding the link between infrastructure and economic outcomes is not easy, and indeed has been a problem that has been at the center of economic debates since Fogel’s famous accounting on the railroad. Further, it is not obvious either theoretically or empirically that infrastructure is good for a region. In the Indian context, no less a sage than the proponent of traditional village life Mahatma Gandhi felt the British railroads, rather than help village welfare, “promote[d] evil”, and we have many trade models where falling trade costs plus increasing returns to scale can decrease output and increase income volatility.

Donaldson looks at the setting of British India, where 67,000 kilometers of rail were built, largely for military purposes.

The Future of Not Working

Annie Lowrey talks UBI via the charity GiveDirectly in The New York Times:

If you’re hungry, you cannot eat a bed net. If your village is suffering from endemic diarrhea, soccer balls won’t be worth much to you. “Once you’ve been there, it’s hard to imagine doing anything but cash,” Faye told me. “It’s so deeply uncomfortable to ask someone if they want cash or something else. They look at you like it’s a trick question.”

A Model of Technological Unemployment

There is a bit of a backlash against UBI in the economics community at the moment, which I think is unfortunately due to a lack of awareness of potential changes to the labor market coming. Here is a paper by Daniel Susskind talking about why mainstream economics may have it wrong on the labor issues:

The economic literature that explores the consequences of technological change on the labour market tends to support an optimistic view about the threat of automation. In the more recent ‘task-based’ literature, this optimism has typically relied on the existence of firm limits to the capabilities of new systems and machines. Yet these limits have often turned out to be misplaced. In this paper, rather than try to identify new limits, I build a new model based on a very simple claim – that new technologies will be able to perform more types of tasks in the future. I call this ‘task encroachment’. To explore this process, I use a new distinction between two types of capital – ‘complementing’ capital, or ’c-capital’, and ‘substituting’ capital, or ‘s-capital’. As the quantity and productivity of s-capital increases, it erodes the set of tasks in which labour is complemented by c-capital. In a static version of the model, this process drives down relative wages and the labour share of income. In a dynamic model, as s-capital is accumulated, labour is driven out the economy and wages decline to zero. In the limit, labour is fully immiserated and ‘technological unemployment’ follows.

Personally I see huge changes coming in the near to medium term (5-40 years), such by the end of that about 40% of currently employed population will have no jobs available to them. (If minimum wage laws hold, that would be literately no jobs, if minimum wage laws fall, then it means jobs that pay only sustenance level). That will cause major changes to the economy of course. Goods will be produced at much lower cost, but how will people who don’t have jobs buy them? This is where UBI begins to make sense to me.

Then in medium to long term we have the potential of AI singularity, in which case, who knows. Even if no singularity, the automation encroachment on refuge labor will continue …

Via MR.

Gurgaon: India's Private City

Powerful. And Mr. Parth Shah speaks my mind exactly: “One simple way to assess success is; do people want to go there? Are people going there willing to settle there, open their businesses [ … ] On all of those counts, Gurgaon has been fabulously successful.”

Under Trump, red states are finally going to be able to turn themselves into poor, unhealthy paradises

Ignore the dumb headline, and stay for this by Steven Pearlstein in The Washington Post:

After all, if Republicans cut taxes — in particular, taxes on investment income — then the biggest winners are going to be the residents of Democratic states where incomes, and thus income taxes, are significantly higher. Governors and legislatures in those states — home to roughly half of all Americans — will now have the financial headroom to raise state income and business taxes by as much as the federal government cuts them — and use the additional revenue to replace all the federal services and benefits that Republicans have vowed to cut.

and think again about how you can move your government more local, and less federal, thanks to republicans.

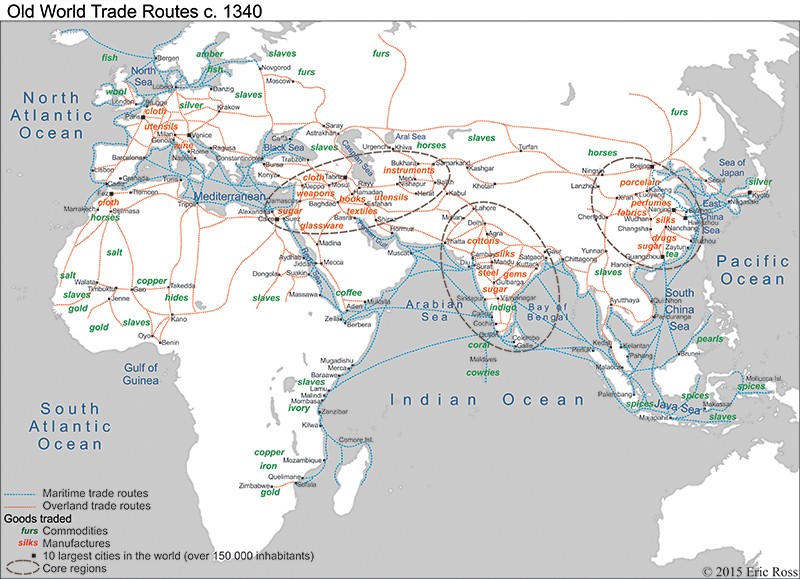

Mapping the Mercantilist World Economy

Our current globalized capitalist world economy was built on Mercantilist foundations, put in place in the first phase of global European expansion, the second phase being that of the formal European empires of the industrial age. In the case of the “New World” in the Americas, Europe’s Mercantilists were creating entirely new trade networks and hinterlands. In the Old World of Afro-Eurasia however, Europe was rearranging the existing, much older, world economy it had been part of since the Middle Ages (see Andre Gunder Frank’s Re-Orient and Jim Blaut’s The Colonizer’s Model of the World). I wanted to illustrate this first phase of global capitalism with thematic maps.

And he continutes through to the Britsh empire ca. 1750.

How can we save our beloved mom-and-pop shops from gentrification?

SARAH GOODYEAR in the NY Daily News with a pretty level headed look at “gentrification”:

In New York, a proposal that would require landlords to offer 10-year leases and submit to binding arbitration when negotiating rents has been stuck in committee for 30 years. Some lawmakers, citing a retail “crisis” sweeping the city, are making a new push to consider some variation on that idea. In Seattle, Councilmember Kshama Sawant, a socialist, has developed a proposal for commercial rent stabilization, although it, too, is not yet scheduled for a vote.

Such legislation is anathema to free-market advocates, who argue that government has no business interfering in the ability of landlords to charge whatever prices they want. They say that residential rent control has distorted the housing market already, and the last thing cities need is even the faintest hint of commercial rent control or subsidy. They dismiss the whole idea as one based on misguided nostalgia.

“The main reason Duane Reades and Walgreens are there is because people purchase there,” Steven Spinola, then-president of the Real Estate Board of New York, told The Villager newspaper last year, in advance of a forum the paper hosted on the issue. “This is a free market. It’s not something that should be negotiated.”

The conclusion gets to the crux of the matter, though people don’t want to believe it, cities change, and if you don’t like it, your only choice is to move on …

Financial Cryptography 2016

Ross Anderson at Light Blue Touchpaper has livebloged Financial Cryptography 2016. Lots of good stuff!

Britcoin or Brit-PESA?

Some high level mulling of a very smart person about the future of digital currency, as relates to the involvment of central banks:

Dave Birch in Consult Hyperion’s blog:

So: imagine something like M-PESA but run by the Bank of England. Everyone has an account and you can transfer money from one account to another by a mobile phone app (that uses the secure TEE in modern mobile phones) or by logging in with two factor authentication to any one of a number of service providers that use the Bank of England API to access the accounts or by phoning a voice recognition and authentication service. Drawing on our experiences from M-PESA, TAP and other population-scale mobile-centric system that we have advised on, I think that this API might actually the most important single thing that a Brit-PESA might deliver to the British economy.

Hiring Without Signals

Readers of Econlog who read co-blogger Bryan Caplan’s posts know that Bryan has posted a lot on a college degree as an expensive signal to potential employers. Here are 88 posts Bryan has written on signaling.

I find Bryan’s argument and evidence persuasive. Like some of his critics, though, I have often wondered why employers don’t figure out cheaper ways of getting information about potential employees. You might argue that the expense is not on the employer but on the employee. But if an employer can find a good employee who lacks a college degree, the employer can, all other things equal, pay less.

In Wednesday’s Wall Street Journal is an interesting news story by Rachel Feintzeg titled “Why Bosses Are Turning to ‘Blind Hiring’.” (WSJ, January 6, 2015, p. B4) [ed. note: see here for the article on archive.is to bypass the paywall].

What Are a Hospital’s Costs? Utah System Is Trying to Learn

Gina Kolata in the NYT:

Only in the world of medicine would Dr. Vivian Lee’s question have seemed radical. She wanted to know: What do the goods and services provided by the hospital system where she is chief executive actually cost?

Most businesses know the cost of everything that goes into producing what they sell — essential information for setting prices. Medicine is different. Hospitals know what they are paid by insurers, but it bears little relationship to their costs.

No one on Dr. Lee’s staff at the University of Utah Health Care could say what a minute in an M.R.I. machine or an hour in the operating room actually costs. They chuckled when she asked.

Are the millions spent on wildlife rehab a waste?

Emily Sohn in Aeon:

Single animals sometimes get care that costs hundreds of thousands of dollars – money that could be spent instead on protecting habitats and other conservation efforts that save far more animals at a time. Could wildlife rehab be a massive waste of time and money?

Duh.

A Sprawl of Ghost Homes in Aging Tokyo Suburbs

Jonathan Soble in the NYT:

The houses are a steal for the rare souls who will have them. But just one has been sold through the home bank so far, a 60-year-old single-story wooden home with a patch of garden that was listed for 660,000 yen, or $5,400. Places farther up the hill can be had for the equivalent of just a few hundred dollars. Four have been rented, including one to students in a nursing-care program at a nearby college who receive a discount in return for checking up on elderly people in the area.

Other towns have tried their own creative solutions, including offering cash payments to outsiders who move in and buy unoccupied homes. A few have succeeded in attracting pockets of artists and freelance workers, who stay tethered by the Internet to their urban clients.

As Minimum Wages Rise, Restaurants Say No to Tips, Yes to Higher Prices

Patricia Cohen in the NYT:

Chelsea Krumpler, a waitress at Manos Nouveau in San Francisco, said that many waiters she knows were skeptical of her $25-an-hour wage and no tips. But she says she is earning as much as before with no worries about slow nights.

“It’s a little more secure,” said Ms. Krumpler, who has worked as a waitress for seven years. The policy has also drawn the staff closer together. “It’s more of a family,” she said.

Brian Keyser, the owner of Casellula restaurant in Midtown Manhattan, would prefer to end tipping but does not think his staff members or his diners are ready to accept it.

Now he must contend with a minimum wage for tipped workers that is rising in New York. That means giving his servers a $2.50-an-hour raise — even if they are already pulling in about $25 an hour in tips. “I have a kitchen full of people making far, far less than that, and I would love to give them that money, but I can’t,” Mr. Keyser said.

Coi, Mr. Patterson’s two-Michelin-star restaurant, has had all-inclusive pricing since it opened in 2006. He tried the same strategy when he opened Aster in the Mission District a few months ago, and quickly realized it was not going to work.

“I really believe in that model, but our customers didn’t want it,” Mr. Patterson said, because they thought it was too expensive. “It’s about perception,” he said. “It’s not just about the dollars you’re spending, but what you think you’re spending.”

At the Walrus and the Carpenter, the owner Renee Erickson has been adjusting her no-tipping experiment. Although she originally wanted to adopt an all-inclusive menu, she “worried we weren’t going to have the opportunity to explain why our prices were so much higher than the restaurant right next door.”

Instead, she added an 18 percent service charge. But it did not generate enough money to cover the added labor costs. So she bumped the charge up to 20 percent and shrank the owners’ share.

As the weeks went by, she and her partner kept adjusting the percentage that went to the kitchen workers. To get the staff on board, she decided to let everyone see the payroll spreadsheets, so they could understand how the money was being allocated.

A cultural problem that really needs to be fixed. The people in the back of house are working just as hard, but they get paid minimum wage, where the servers are making good money. It is illegal for owners to pool tips and share with back of house, so looks like service charges and no tipping allowed is the only way out.

The way we think about charity is dead wrong

Activist and fundraiser Dan Pallotta calls out the double standard that drives our broken relationship to charities. Too many nonprofits, he says, are rewarded for how little they spend – not for what they get done. Instead of equating frugality with morality, he asks us to start rewarding charities for their big goals and big accomplishments (even if that comes with big expenses).

The problem however is that if the extra spending just takes money away from other charities, then it is a net loss in the whole picture. The only way this wins is if the 2% of GDP grows, and the money is taken away from the for profit sector. I think this is unlikely to happen, charitable giving is probably pretty firmly stuck there. without societal change (which is why he is spending the money, to create this, but, risky).